Does retirement still seem decades away or completely unattainable? If you feel like full retirement is out of reach, you’re not alone. According to a recent survey by the Transamerica Center for Retirement Studies, only 17% of Generation X workers are very confident they will be able to fully retire with a comfortable lifestyle.

Unlike younger generations that started saving for retirement as soon as they landed their first jobs, Generation X didn’t start saving until later. In the 1980's and 1990's, 401k plans were just starting to be offered by employers and pensions were a relic of the past. This resulted in a generation that feels unsure about how they are going to fund their upcoming retirement.

While we can’t offer a time machine to go back and expand your retirement accounts, we can provide retirement savings tips to boost your current savings. At Palisades Credit Union, the financial health of our community is a top priority. Here are 7 steps you can take after age 50 to help maximize your chances of a comfortable retirement.

Define Your Retirement Goals

In order to feel confident about retirement, you need a clear picture of what you would like retirement to look like. Ask yourself the following questions to better understand your retirement needs.

- Will you stay in your current home or downsize?

- Will you move to an area with a different cost of living?

- Do you picture yourself traveling often to visit family or far-off destinations?

- Will you be financially responsible for anyone besides yourself?

- How much money do you currently have in a retirement account?

- Do you have additional savings or investments that can be added to a retirement fund?

Fund Your 401K

If you’re wondering how to catch up on retirement savings, maximizing your contributions is key. Start by looking at your monthly budget. You likely have unnecessary expenses that can be shaved to make larger contributions to your retirement. While cutting back on entertainment, dining out, and impulse spending may seem like a sacrifice at first, consider the peace of mind that a well-funded retirement account brings.

In 2024, you can contribute a maximum of $23,000 towards your 401(k), 403(b), most 457 plans, and the Thrift Savings Plan. Increasing your retirement contributions now will give your money time to grow and help build a bigger nest egg. If your employer offers matching contributions, be sure to maximize those as well. Employer contributions aren’t completely yours until you are fully vested, so plan to keep your job until that time.

Use Catch-Up Contributions

If saving for retirement wasn’t a priority when you were younger, you have the chance to make up for lost time. The IRS allows aspiring retirees over the age of 50 to save an extra $7,500 in a 401(k), $1,000 in an HAS, and $1,000 in an IRA each year. These catch-up contributions can begin in January on the year you turn 50 – you don’t have to wait until your specific birthday. Starting this year, catch-up contribution limits will be indexed to inflation. This will help your catch-up contributions keep pace with the cost of living.

Starting in 2026, your income may affect your ability to make catch-up contributions to your 401(k). If your yearly income is $145,000 or more, your extra contributions must be placed in a Roth 401(k). This means that your catch-up contributions will come from after-tax dollars, but your retirement withdrawals will be tax free.

Open an IRA

To take advantage of a 401(k), the retirement account must be offered by your employer. An IRA, on the other hand, is an individual retirement account available to anyone with earned income. If you’re maxing out your 401(k), or your employer doesn’t offer one, an IRA can offer some of the same benefits. Save for retirement with a Roth or Traditional IRA.

Roth IRA - Contributions to a Roth IRA are made with after-tax dollars. This means your retirement withdrawals are tax-free. The maximum contribution in 2023 was $6,500 ($7,500 if you are age 50 or older). There are some eligibility restrictions for Roth IRAs so speak with an investment banker at Palisades to discuss your options.

Traditional IRA - Contributions to a traditional IRA are made with pre-tax dollars resulting in a tax break while you are still working. As a result, all withdrawals are taxed at the future federal and state income tax rates when you retire.

Stop Letting Your Money Simmer

It’s not uncommon to feel uneasy about investing your retirement money. If you’re letting your money sit in a traditional savings account because you’re afraid of investing, you could be letting a lot of money slip away. At the bare minimum, move your retirement savings into a high yield savings account.

Unlike traditional savings account that earn around 0.4 percent interest, a high yield savings account can earn upwards of 4.5 percent. If you already have investment accounts dedicated to retirement, open a high yield savings account for emergencies. You can always transfer the interest you earn into your retirement savings, making it easier to maximize your contributions. Check out the current interest rates customers are earning at Palisades Credit Union.

Pay Down and Avoid Large Debt

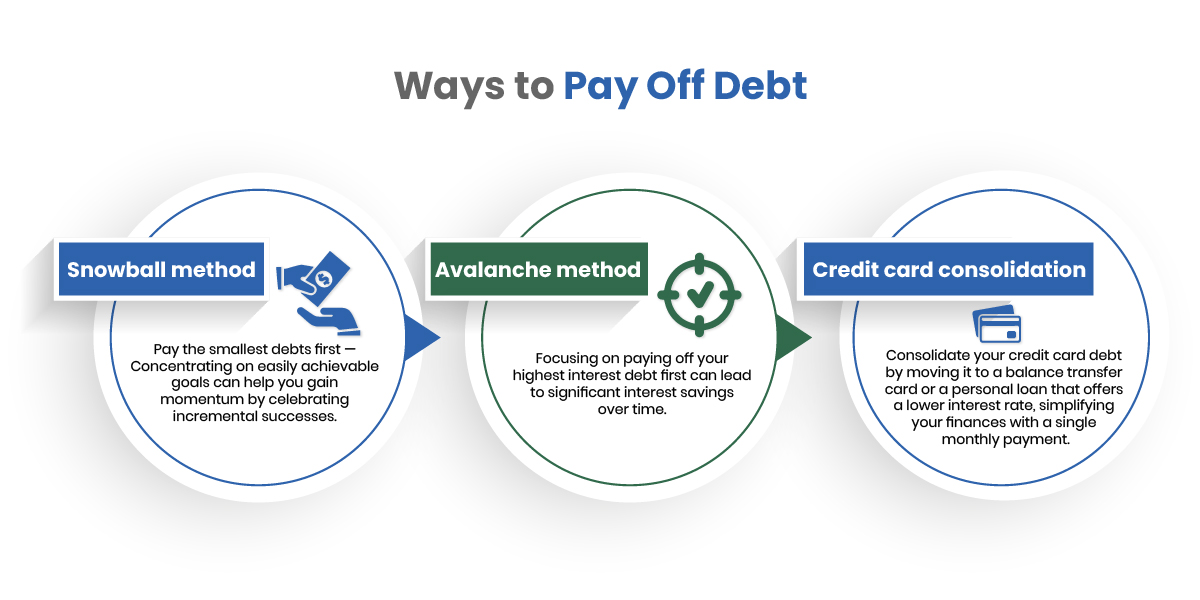

If you plan to fully retire from work, you’ll be living on a fixed income for many years. Do yourself a huge favor and pay off debts now so you won’t have loan payments eating up your retirement income.

The best place to start is credit card debt. If you’re currently locked into a high interest credit card, research balance transfer offers to find a card with zero or little introductory interest. Take advantage of the introductory period to pay off the debt as quickly as possible. Ridding yourself of credit card debt helps create a stress-free retirement.

If you don’t have credit card debt weighing you down, consider refinancing your mortgage or paying it off completely. The money you save on loan interest can be used to support your future retirement lifestyle. As you inch closer to your target retirement age, refrain from making large purchases that will create new debt. The less debt you have at retirement, the greater your chances are of enjoying your golden years.

Don’t Dip into Social Security

If you were born after 1960, you can start receiving Social Security benefits at a reduced rate starting at age 62. If you want to receive your full benefits, however, don’t start dipping into Social Security until age 67. For every month you delay taking your benefits, the monthly payout increases. If you delay beyond age 67, the extra income adds up quickly. The incentive to delay your Social Security payments ends at age 70.

Open a Retirement Account Today

Whether you live in Rockland or Bergen County, retirement in New York is not out of reach. At Palisades Credit Union we support your retirement goals. Through high-yield savings accounts, money market accounts, and Traditional and Roth IRAs, we have the investment tools you need to save big.

It’s not too late to prioritize your retirement even if you have no retirement savings. If you need help getting started or have questions about the right retirement accounts for you, the knowledgeable associates at Palisades are here to help. Contact us today or stop by one of our convenient locations in Nanuet, Orangeburg, and New City.

« Return to "Blog"