Getting a new or new-to-you car can be an exciting time. However, unless you’re prepared to pay cash for your next ride, you’ll need to decide whether to lease or finance your vehicle. With car prices rising in recent years, leasing a new car may be more attractive or affordable than buying one. However, there are pros and cons associated with both buying and leasing. What’s right for you will depend on a variety of factors. Keep reading to learn everything you need to know to choose between financing or leasing your next vehicle.

What does it mean to lease a car?

Leasing a car essentially means renting it from the dealership. Lease periods usually last two or three years and you are also limited in the amount of miles you can put on the vehicle during the lease period. Your lease will also specify whether you have the option of buying the car from the dealer at the end of the leasing period or not. As with financing a car purchase, your credit score will impact your ability to lease a car. Your lease-payment history also appears on your credit report, so make sure you can afford the monthly lease payments and don’t be late or skip a payment altogether.

What are the benefits of leasing a car?

Leasing your next vehicle means paying to drive a new car, but not owning it. This can be the right option for some people depending on your situation and goals. Learn about the benefits of leasing a car:

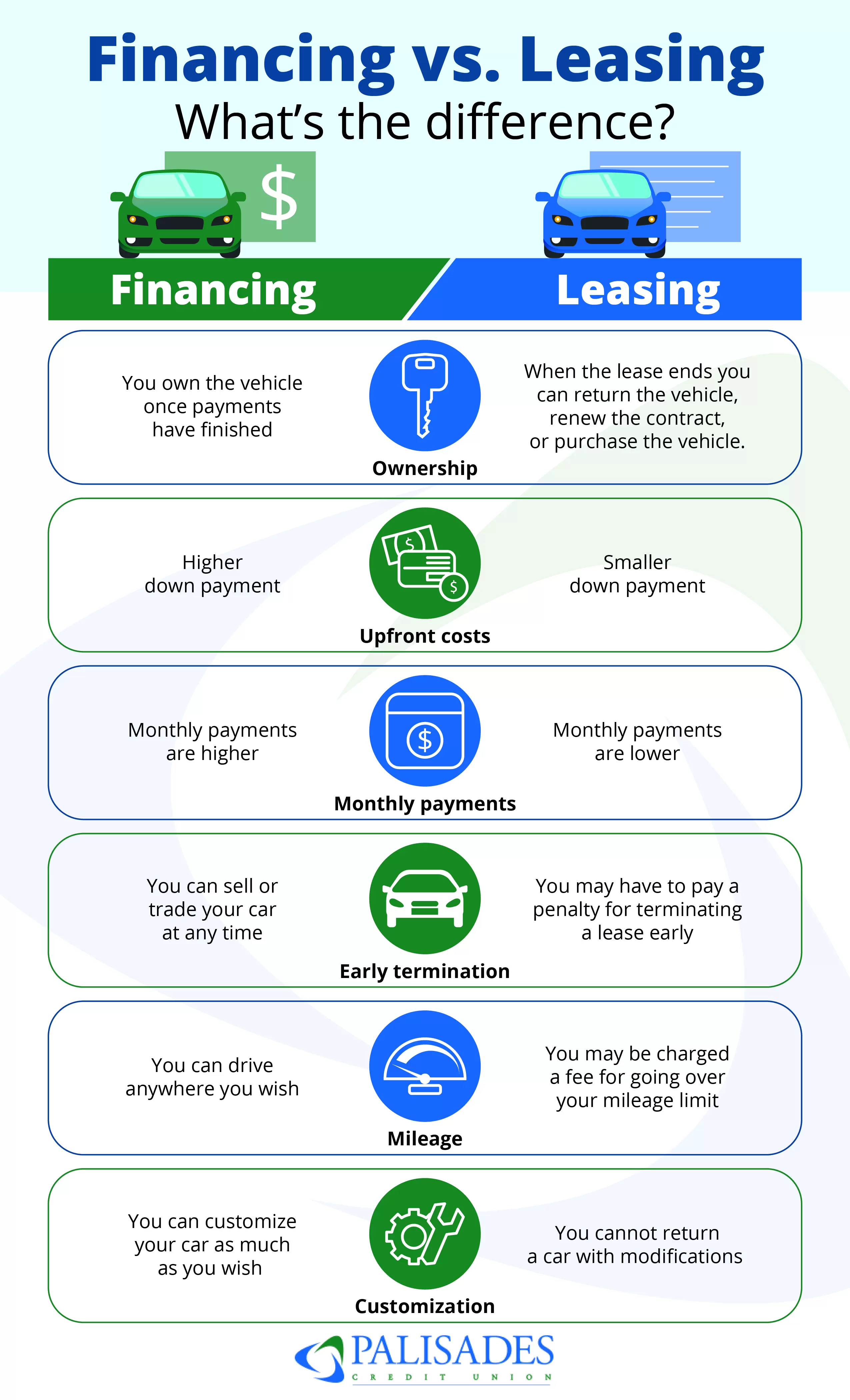

- Monthly lease payments are typically lower than if you took out a car loan to buy the same vehicle.

- You’re not paying for the entire vehicle, just the value you use for the time you’re driving it.

- Normal wear and tear is covered by the terms of your lease, but you will be financially responsible for any damage in excess of normal limits (unless you purchase the vehicle).

- If you jump from lease to lease, you will always get to drive a new, recent car model.

- Leasing means you can drive a more expensive car than you can afford to purchase.

- You don’t have to worry about trade-in value.

- If you’re leasing for business purposes, you may get a tax break.

What are the downsides of leasing a vehicle?

Of course, leasing a car may be right for some, but it won’t be the best option for everyone. Here are the cons to the previous list of pros:

- You make monthly payments, but you don’t own the vehicle.

- If you constantly lease, you will always have a car payment but never own the car.

- Do you have a long commute or drive a lot? You may have to pay mileage overage charges if you go over the mileage limit.

- Do you have young children who tend to make messes in your car? You may be responsible for excessive wear and tear on the vehicle.

- You can only make customizations at the beginning of your lease.

- You end up paying more because you’re using the car during the time it most rapidly depreciates.

- It can be difficult to get out of a lease. If you find you no longer want or can afford the car, you may have to pay early termination fees.

- Leasing may actually have more strict credit requirements than applying for auto loan financing.

What does it mean to finance a vehicle?

When you finance your vehicle purchase, you take out an auto loan and repay the amount borrowed, plus interest, over a period of time from about three-five years. Because an auto loan is a secured loan, meaning the car financed can be repossessed if the borrower defaults, it usually comes with low rates (depending on your credit score and finances). Just remember that, while a longer loan term will lower your monthly payment, you will pay more in interest over a longer loan term.

Contrary to what you may think, the dealership is not the only place to obtain auto financing. Banks and credit unions like Palisades also offer auto loans at competitive rates for new or used vehicle purchases.

What are the benefits of financing vs. leasing a vehicle?

So, what are the reasons why you might choose to finance your next vehicle purchase instead of leasing?

- You own the vehicle after the loan is paid off.

- You can make any customizations or modifications any time you want to.

- You’re not subject to mileage restrictions.

- You can sell or trade-in the car if it no longer meets your needs.

What are the cons of financing vs. leasing?

On the other hand, when might people choose to lease instead of financing a car purchase?

- Monthly payments are usually higher on a car loan because you’re paying off the entire purchase price of the vehicle, plus interest, taxes, finance charges, and fees.

- When you just want to pay for the time you have the vehicle, instead of paying for the entire value of the vehicle.

When to lease or finance a vehicle

Leasing is a great option for those who are unable to meet down payment requirements for auto loans or who prioritize driving a new vehicle over ownership. However, Palisades does offer up to 100% financing on auto loans, eliminating the down payment requirement or allowing you to make a small one. Ultimately, financing a vehicle is a short-term solution to establishing equity in your car so that you can use it for many years after it’s been paid off.

Need to finance a vehicle in Rockland or Bergen County?

At Palisades Credit Union, we offer a comprehensive range of products and services to make the purchase and financing of a new or used vehicle swift and stress-free. Apply online for a car loan or visit us in Orangeburg, Nanuet or New City. You can also view our current auto loan interest rates and use our car loan calculator to figure out how much you can afford to borrow. Have questions? Talk to a vehicle financing specialist today!

« Return to "Blog" Go to main navigation